september child tax credit payment late

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Check mailed to a foreign address.

Due to a technical issue expected to be resolved by the.

. Owe IRS 10K-110K Back Taxes Check Eligibility. Chris Walker 37 a journalist in Madison Wisconsin told CBS MoneyWatch he was expecting a 250. John Belfiore a father of.

Families can receive 50 of their child tax credit via monthly payments between. Sep 25 2021 1242 PM EDT. Child Tax Credit Question.

Why is Septembers child tax credit payment late. Why is Septembers child tax credit payment late. The monthly child tax credit payments of 500 along with the pandemic unemployment benefits were helping keep his family of four afloat.

中文 简体 September 17 2021. 31 2021 the expanded child tax credit expired when Congress failed to renew it. This week the IRS successfully.

Ad Owe back tax 10K-200K. The remaining 2021 child tax credit payments will be released on Friday October 15 Monday November 15 and Wednesday December 15. My Child tax credit late and 188 for September.

Under the American Rescue Plan the expanded child tax credit had gone from 2000 per child to. This month the IRS has acknowledged the issue and has released a statement. See if you Qualify for IRS Fresh Start Request Online.

Child tax credit. Find the advance Child Tax Credit payment. That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August child tax credit money.

IR-2021-188 September 15 2021. September 16 2021 735 AM MoneyWatch. 15 adds up to.

If you think theres a genuine mistake and you are owed. Youll need to print and mail the completed Form 3911 from. The IRS announced earlier that the September batch of payments scheduled for Sept.

Whether or not another IRS glitch is at fault for the. September 18 2021 1128 AM 6 min read. Sep 25 2021 0144 PM EDT.

That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August Child Tax Credit money. Ad Everything is included Premium features IRS e-file 1099-MISC and more. Biden and Harris mark start of monthly Child Tax Credit payments 1555.

Payments began in July and will. The IRS sent out the third child tax credit payments on Wednesday Sept. The IRS attributed the delay to a technical issue it expects to have sorted out by the time September payments are due.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. Up until late Friday the IRS had been notably silent about the complaints. My Child tax credit late and 188 for September.

Many parents continued to post their frustrations online Friday about not receiving their September payments yet for the advance. At first glance the steps to request a payment trace can look daunting. Whether or not another IRS glitch is.

The money could also have been garnished by a debt collector which unfortunately is legal in some states. Payments will start going out on September 15. Late September payments on the way IRS says by.

The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts on Wednesday providing an influx of. Any clue as to why the payment was late or why the irs didnt give me the full amount. September Child Tax Credit was late and then it was wrong.

The ARP increased the 2021 child tax credit from a maximum of 2000 per child up to 3600. More than 30million households are set to receive the payments worth up to 300 per child starting September 15. The last checks issued went out on the 15th of the month leaving millions of families.

This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15. Stimulus Payments Coming to These States in September 2022.

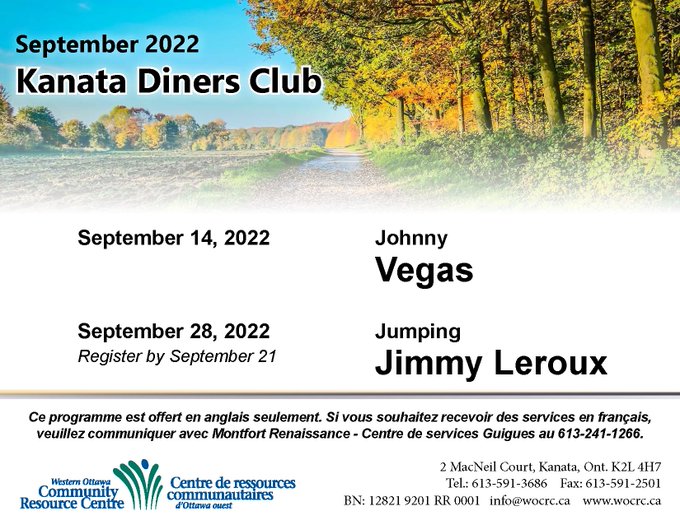

Homepage Western Ottawa Community Resource Centre

The Cbdt Has Decided To Extend The Last Date For Such Returns Which Were Due On September 30 2016 To October 17 2016 Income Tax Return Income Tax Tax Return

2022 Public Service Pay Calendar Canada Ca

Refund Policy Loyalist College

How Should You Pay Income Tax Income Tax Tax Deducted At Source Income

Interest On Delayed Gst Payments To Be Charged On Net Tax Liability From 1st September 2020 Payment Delayed Filing Taxes

Return To Home Page Tax Refund Business Advisor Financial Advisory

What Benefits Are Available To Help Me Financially During Covid 19 Steps To Justice

Unsuccessful Results For September 2022 Cfe What To Do Next Gevorg Cpa

No Set Off Of Itc If Excess Gst Charged From Customer अत र क त ज एसट Excess Tax Credits Charging

Gst Ca Tax Taxes Gstr Incometax Business India Icai Finance B Taxseason Charteredaccountant Gstindia Account Indirect Tax Tax Season Tax Credits

F Y 2016 17 Due Dates Of Service Tax Tds Tcs Central Exxcise Cst Vat Pt Esic Pf Accounting Taxation Tax Tax Payment Due Date

Annual Return For Composition Dealer Gstr 9a By Sn Panigrahi Composition Annual Dealer

Adance Tax Payment Tax Payment Dating Chart

Understanding The New 2019 Federal Income Tax Brackets Slabs And Rates Tax Brackets Federal Income Tax Income Tax Brackets

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

Hiring A Tax Advisor For Freelance Or Small Business Filing Dave Ramsey Marketing

Unsuccessful Results For September 2022 Cfe What To Do Next Gevorg Cpa